Multiple Choice

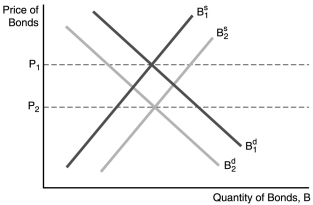

-In the figure above,the price of bonds would fall from P₁ to P₂ when

A) inflation is expected to increase in the future.

B) interest rates are expected to fall in the future.

C) the expected return on bonds relative to other assets is expected to increase in the future.

D) the riskiness of bonds falls relative to other assets.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: _ in the money supply creates excess

Q17: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5039/.jpg" alt=" -In the figure

Q38: Both the CAPM and APT suggest that

Q76: In contrast to the CAPM,the APT assumes

Q94: If real estate prices are expected to

Q126: Everything else held constant,a decrease in wealth<br>A)increases

Q130: Everything else held constant,when stock prices become

Q134: Everything else held constant,when the government has

Q156: When the price level _,the demand curve

Q157: Everything else held constant,when the inflation rate