Multiple Choice

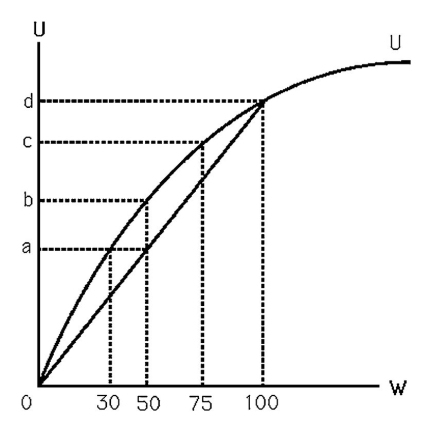

-The above figure shows Bob's utility function.He currently has $100 of wealth,but there is a 50% chance that it could all be stolen.Bob is risk averse because

A) his utility function is convex.

B) he has negative marginal utility of wealth.

C) he is willing to pay a premium to avoid a risky situation.

D) All of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A risk-neutral person will invest in a

Q2: A lottery game pays $500 with .001

Q3: What is one reason car insurance seems

Q5: A rational person maximizes<br>A) risk.<br>B) return.<br>C) expected

Q6: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6808/.jpg" alt=" -The above figure

Q7: If an individual makes her investment decisions

Q8: For a risk-neutral person,the expected utility associated

Q9: If two events are perfectly positively correlated,then<br>A)

Q10: The expected utility theory<br>A) predicts all actions

Q11: One reason health insurance is very expensive