Multiple Choice

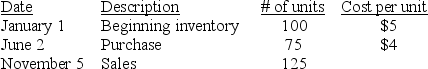

Maxell Company uses the FIFO method to assign costs to inventory and cost of goods sold.The company uses a periodic inventory system.Consider the following information:

What amounts would be reported as the cost of goods sold and ending inventory balances for the year?

A) Cost of goods sold $625; Ending inventory $175

B) Cost of goods sold $755; Ending inventory $225

C) Cost of goods sold $550; Ending inventory $250

D) Cost of goods sold $600; Ending inventory $200

Correct Answer:

Verified

Correct Answer:

Verified

Q29: FIFO,LIFO,and weighted average inventory costing methods are

Q34: For a manufacturer,inventory turnover refers to how

Q60: If inventory is updated periodically,which of the

Q75: A $15,000 overstatement of the current year's

Q78: Sun Concepts sells and installs solar energy

Q81: Eaton Electronics uses a periodic inventory system.On

Q85: Pinkney Company updates its inventory periodically.The company's

Q136: The assumption that a company makes about

Q165: In a period of rising prices,the inventory

Q216: In a period of rising prices,the inventory