Essay

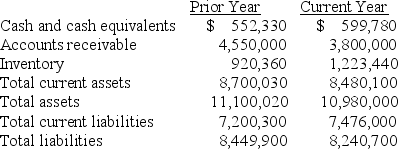

The financial information below presents selected information from the financial statements of Pelican Company.Sales revenue during the current year was $13,700,300 and cost of goods sold was $8,905,195.All of Pelican's sales are made on account and are due within 30 days.

Required:

Part a.Current ratios as of the end of the current and prior year.

Part b.Calculate the receivables turnover ratio for the current year.

Part c.Calculate the days to collect for the current year.

Part d.Calculate the inventory turnover ratio for the current year.

Part d.Calculate the days to sell for the current year.

Part e.Evaluate the company's liquidity position at the end of the current year.Cite any additional information not given in the problem that would be helpful in evaluating the company's liquidity.

Round all ratios to two decimal places.

Correct Answer:

Verified

Part a

Current ratio = Current assets ÷ ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Current ratio = Current assets ÷ ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: A current ratio of less than one

Q68: Company A uses the FIFO inventory method

Q75: Which of the following is calculated by

Q94: The ratio that measures how many times

Q99: Which income statement line item had the

Q106: Choose the appropriate letter to match the

Q130: Which of the following is not a

Q151: Listed below are the current ratios of

Q167: A current ratio of 2.5 means that

Q178: The going-concern assumption states that the:<br>A)company will