Multiple Choice

TABLE 7.2

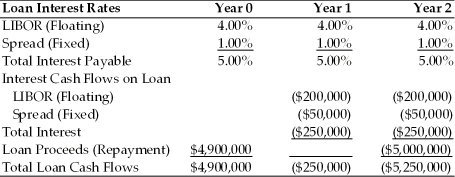

Use the information for Polaris Corporation to answer the following question(s) .

Polaris is taking out a $5,000,000 two-year loan at a variable rate of LIBOR plus 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 2.00%

-Refer to Table 7.2. If the LIBOR rate jumps to 5.00% after the first year what will be the all-in-cost (i.e. the internal rate of return) for Polaris for the entire loan?

A) 5.25%

B) 5.50%

C) 6.09%

D) 6.58%

Correct Answer:

Verified

Correct Answer:

Verified

Q14: An agreement to exchange interest payments based

Q51: Which of the following statements regarding currency

Q54: For the following problem(s), consider these debt

Q55: A call option whose exercise price is

Q56: TABLE 7.2<br>Use the information for Polaris Corporation

Q59: Futures contracts require that the purchaser deposit

Q60: For the following problem(s), consider these debt

Q63: Polaris Inc. has a significant amount of

Q85: About _ of all futures contracts are

Q86: Compare and contrast foreign currency options and