Essay

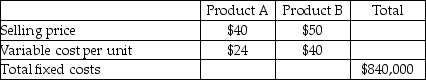

Mount Carmel Company sells only two products, Product A and Product B.

Mount Carmel sells two units of Product A for each unit it sells of Product B. Mount Carmel faces a tax rate of 30%.

Required:

a.What is the breakeven point in units for each product assuming the sales mix is 2 units of Product A for each unit of Product B?

b.What is the breakeven point if Mount Carmel's tax rate is reduced to 25%, assuming the sales mix is 2 units of Product A for each unit of Product B?

c.How many units of each product would be sold if Mount Carmel desired an after-tax net income of $73,500, facing a tax rate of 30%?

Correct Answer:

Verified

a.N = breakeven in product B 2N = breake...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q137: A company with sales of $50,000, a

Q138: If a company is planning to reduce

Q139: If planned net income is $30,000 and

Q140: Lights Manufacturing produces a single product that

Q141: If the contribution margin ratio is 0.25,

Q143: At breakeven point, _.<br>A) operating income is

Q144: A decision table is a summary of

Q145: Answer the following questions using the information

Q146: Contribution margin = Contribution margin percentage ×

Q147: Burgandy Manufacturing produces a single product that