Essay

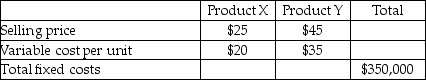

Atlanta Radio Supply sells only two products, Product X and Product Y.

Atlanta Radio Supply sells three units of Product X for each two units it sells of Product Y. Atlanta Radio Supply has a tax rate of 25%.

Required:

a.What is the breakeven point in units for each product, assuming the sales mix is 3 units of Product X for each two units of Product Y?

b.How many units of each product would be sold if Atlanta Radio Supply desired an after-tax net income of $210,000, using its tax rate of 25%?

Correct Answer:

Verified

a.3N = breakeven in product X 2N = break...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: SaleCo sells 11,000 units resulting in $110,000

Q24: Fine Suiting Company sells shirts for men

Q25: Stones Manufacturing sells a marble slab for

Q26: Family Furniture sells a table for $900.

Q27: What would be the expected monetary value

Q29: Gross Margin will always be greater than

Q30: Katrina's Bridal Shoppe sells wedding dresses. The

Q31: The contribution margin per unit equals .<br>A)

Q32: Auto Tires has been in the tire

Q33: Sparkle Jewelry sells 600 units resulting in