Multiple Choice

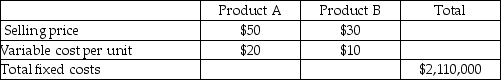

Stella Company sells only two products, Product A and Product B.

Stella sells two units of Product A for each unit it sells of Product B. Stella faces a tax rate of 40%. Stella desires a net after-tax income of $54,000. The breakeven point in units would be ________.

A) 25,250 units of Product A and 50,500 units of Product B

B) 27,500 units of Product A and 55,000 units of product B

C) 50,500 units of Product A and 25,250 units of Product B

D) 55,000 units of Product A and 27,500 units of Product B

Correct Answer:

Verified

Correct Answer:

Verified

Q49: What is sales mix? How do companies

Q50: Sensitivity analysis is _.<br>A) a way of

Q51: Sales of Blistre Autos are 380,000, variable

Q52: Ballpark Concessions currently sells hot dogs. During

Q53: A planned decrease in selling price would

Q55: In a company with low operating leverage,

Q56: All else being equal, an increase in

Q57: The following information is for Alex Corp:<br>

Q58: A profit-volume graph shows the impact on

Q59: Contribution margin and gross margin are terms