Multiple Choice

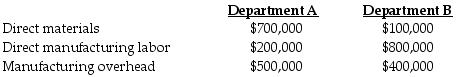

Apple Valley Corporation uses a job cost system and has two production departments, A and B. Budgeted manufacturing costs for the year are:

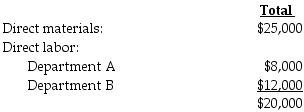

The actual material and labor costs charged to Job #432 were as follows:

Apple Valley applies manufacturing overhead costs to jobs on the basis of direct manufacturing labor cost using departmental rates determined at the beginning of the year.

For Department B, the manufacturing overhead allocation rate is ________.

A) 50.0%

B) 90.0 %

C) 200.0%

D) 250.0%

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Job-costing is likely to be used by_.<br>A)

Q17: In each period, job costing divides the

Q18: Which account is debited if materials costing

Q19: Process costing is used to assign manufacturing

Q20: A company has $25,000 of depreciation on

Q22: Lancelot Manufacturing is a small textile manufacturer

Q23: The Dougherty Furniture Company manufactures tables. In

Q24: The Robinson Corporation manufactures automobile parts. During

Q25: Benny Industries allocates manufacturing overhead at a

Q26: A _ is anything for which a