Essay

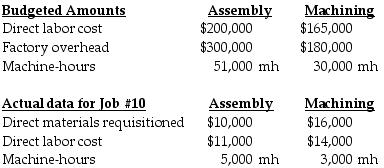

Jordan Company has two departments, Assembly and Machining. Overhead is applied based on direct labor cost in Department Assembly and machine-hours in Department Machining. The following additional information is available:

Required:

a.Compute the budgeted factory overhead rate for Assembly.

b.Compute the budgeted factory overhead rate for Machining.

c.What is the total overhead cost of Job 10?

d.If Job 10 consists of 50 units of product, what is the unit cost of this job?

Correct Answer:

Verified

a.$300,000/$200,000 = 150%

b.$180,000/30...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.$180,000/30...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: Work-in-Process Control will be decreased (credited) for

Q46: For 2018, Winters Manufacturing uses machine-hours as

Q47: The budgeted indirect-cost rate is calculated _.<br>A)

Q48: When manufacturing overhead is allocated to jobs,

Q49: The Salaries Payable Control account has underlying

Q51: A local CPA employs ten full-time professionals.

Q52: River Falls Manufacturing uses a normal cost

Q53: When an organization allocated indirect costs to

Q54: For 2018, Franklin Manufacturing uses machine-hours as

Q55: Explain the procedure how overhead indirect costs