Essay

Moira Company has just finished its first year of operations and must decide which method to use for adjusting cost of goods sold. Because the company used a budgeted indirect-cost rate for its manufacturing operations, the amount that was allocated ($435,000) to cost of goods sold was different from the actual amount incurred ($425,000).

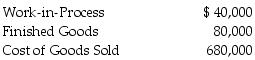

Ending balances in the relevant accounts were:

Required:

a.Prepare a journal entry to write off the difference between allocated and actual overhead directly to Cost of Goods Sold. Be sure your journal entry closes the related overhead accounts.

b.Prepare a journal entry that prorates the write-off of the difference between allocated and actual overhead using ending account balances. Be sure your journal entry closes the related overhead accounts.

Correct Answer:

Verified

a.11ecb4bd_1eed_27b7_8164_c136...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: Fixed costs remain constant at $450,000 per

Q89: Direct costs of a cost object are

Q90: If indirect-cost rates were based on actual

Q91: The _ adjusts individual job-cost records to

Q92: Apple Valley Corporation uses a job cost

Q94: When $10,0000 direct materials are requisitioned, which

Q95: The cost-allocation base is a systematic way

Q96: Which of the following statements regarding manufacturing

Q97: In some service organizations, a variation of

Q98: Direct materials and direct manufacturing labor become