Essay

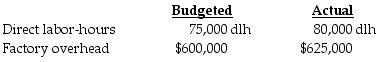

The following information was gathered for Longview Company for the year ended December 31, 2018:

Assume that direct labor-hours are the cost-allocation base.

Required:

a.Compute the budgeted factory overhead rate.

b.Compute the factory overhead applied.

c.Compute the amount of over/underapplied overhead.

Correct Answer:

Verified

a.$600,000/75,000 hrs. = $8.00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q135: Advantage Inc. employs 29 professional cleaners. Budgeted

Q136: The approach often used when dealing with

Q137: Filippucci Company used a budgeted indirect-cost rate

Q138: Sky High Company has two departments, X

Q139: A local accounting firm employs 24 full-time

Q141: Allocating indirect costs to departments based on

Q142: Companies often use multiple cost-allocation bases to

Q143: Grounds-maintenance costs incurred during the summer months

Q144: Jacobs Company manufactures refrigerators. The company uses

Q145: Manufacturing overhead costs incurred for the month