Multiple Choice

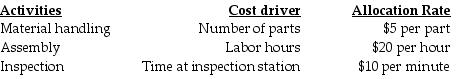

Nichols Inc. manufactures remote controls. Currently the company uses a plant-wide rate for allocating manufacturing overhead. The plant manager is considering switching-over to ABC costing system and has asked the accounting department to identify the primary production activities and their cost drivers which are as follows:

The current traditional cost method allocates overhead based on direct manufacturing labor hours using a rate of $20 per labor hour.

What are the indirect manufacturing costs per remote control assuming an activity-based-costing method is used and a batch of 10 remote controls are produced? The batch requires 100 parts, 5 direct manufacturing labor hours, and 3 minutes of inspection time.

A) $2.00 per remote control

B) $63.00 per remote control

C) $35.00 per remote control

D) $630.00 per remote control

Correct Answer:

Verified

Correct Answer:

Verified

Q64: Excellent Printing has contracts to complete weekly

Q65: Facility-sustaining costs are the costs of activities

Q66: Aunt Ethel's Fancy Cookie Company manufactures and

Q67: Extracts from cost information of Hebar Corp.:<br><img

Q68: What are the four parts of the

Q70: ABC systems and department costing systems use

Q71: Nile Corp. has identified three cost pools

Q72: Stark Corporation has two departments, Car Rental

Q73: Answer the following questions using the information

Q74: Activity-based costing attempts to identify the most