Multiple Choice

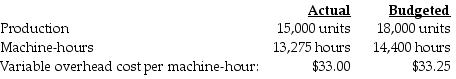

Russo Corporation manufactured 15,000 air conditioners during November. The overhead cost-allocation base is $33.25 per machine-hour. The following variable overhead data pertain to November:

What is the flexible-budget amount?

A) $441,394

B) $399,000

C) $396,000

D) $475,200

Correct Answer:

Verified

Correct Answer:

Verified

Q135: A favorable production-volume variance arises when manufacturing

Q136: Majestic Corporation manufactures wheel barrows and uses

Q137: Cold Products Corporation manufactured 32,000 ice chests

Q138: Variable overhead has no production-volume variance.

Q139: Managers can use variance analysis to make

Q141: Mendel Company makes the following journal entry:<br>Variable

Q142: Which of the following is a component

Q143: Effective planning of fixed overhead costs includes

Q144: Hockey Accessories Corporation manufactured 23,000 duffle bags

Q145: Prorated allocation of production-volume variance results in