Multiple Choice

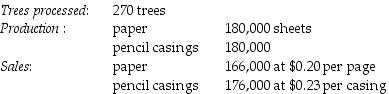

Bismite Corporation purchases trees from Cheney lumber and processes them up to the split-off point where two products (paper and pencil casings) emerge from the process. The products are then sold to an independent company that markets and distributes them to retail outlets. The following information was collected for the month of October:

The cost of purchasing 270 trees and processing them up to the split-off point to yield 180,000 sheets of paper and 180,000 pencil casings is $15,000.

Bismite's accounting department reported no beginning inventory.

What are the paper's and the pencil's approximate weighted cost proportions using the sales value at

Split-off method, respectively?

A) 50.00% and 50.00%

B) 45.06% and 54.94%

C) 48.54% and 51.46%

D) 46.51% and 53.49%

Correct Answer:

Verified

Correct Answer:

Verified

Q81: Joint costing allocates the joint costs to

Q82: Which of the following statements is true

Q83: A company manufactures three products, A, B,

Q84: Separable costs include manufacturing costs only.

Q85: Explain the difference between a joint product

Q87: Bismite Corporation purchases trees from Cheney lumber

Q88: Allocating joint costs to individual products can

Q89: The only allowable method of joint cost

Q90: Which of the following statements best define

Q91: For each of the following methods of