Multiple Choice

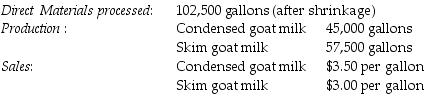

The Green Company processes unprocessed goat milk up to the split-off point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the of unprocessed goat milk and processing it up to the split-off point to yield a total of 102,500 gallons of saleable product was $189,480. There were no inventory balances of either product. Condensed goat milk may be processed further to yield 44,500 gallons (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $6 per usable gallon. Xyla can be sold for $22 per gallon.

Skim goat milk can be processed further to yield 56,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $6. The product can be sold for $14 per gallon.

There are no beginning and ending inventory balances.

How much (if any) extra income would Green earn if it produced and sold all of the Xyla from the condensed goat milk? Allocate joint processing costs based upon relative sales value on the split-off. (Extra income means income in excess of what Green would have earned from selling condensed goat milk.) (Round intermediary percentages to the nearest hundredth.)

A) $621,566

B) $277,100

C) $554,500

D) $350,554

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Calamata Corporation processes a single material into

Q16: The constant gross-margin percentage NRV method is

Q17: Which of the following statements is true

Q18: How does the sales value at split-off

Q19: Firms should be wary of using the

Q21: Which of the following statements is true

Q22: Torid Company processes 18,175 gallons of direct

Q23: In joint costing, the sales value at

Q24: Which if the following is a negative

Q25: Beverage Drink Company processes direct materials up