Multiple Choice

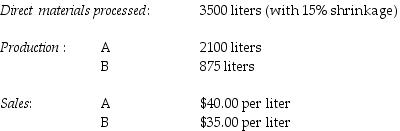

Cola Drink Company processes direct materials up to the split-off point where two products, A and B, are obtained. The following information was collected for the month of July:

The cost of purchasing 3500 liters of direct materials and processing it up to the split-off point to yield a total of 2975 liters of good products was $7000. There were no inventory balances of A and B.

Product A may be processed further to yield 2000 liters of Product Z5 for an additional processing cost of $160. Product Z5 is sold for $60.00 per liter. There was no beginning inventory and ending inventory was 125 liters.

Product B may be processed further to yield 800 liters of Product W3 for an additional processing cost of $290. Product W3 is sold for $65 per liter. There was no beginning inventory and ending inventory was 25 liters.

What is Product Z5's estimated net realizable value at the split-off point?

A) $51,840

B) $83,840

C) $119,840

D) $120,000

Correct Answer:

Verified

Correct Answer:

Verified

Q111: Which of the methods of allocating joint

Q112: In each of the following industries, identify

Q113: The Green Company processes unprocessed goat milk

Q114: Which of the following is true of

Q115: Joint costs are incurred beyond the split-off

Q117: Timber logs are processed into standard lumber

Q118: The net realizable value (NRV) method method

Q119: Which of the following is not true

Q120: Distinguish between the two principal methods of

Q121: What are the two methods to account