Multiple Choice

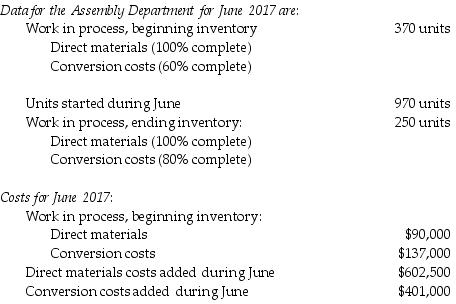

Timekeeper Inc. manufactures clocks on a highly automated assembly line. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Timekeeper Inc. uses weighted-average costing.

What are the equivalent units for direct materials and conversion costs, respectively, for June? (Round final answers to the nearest unit.)

A) 1340 units; 1050 units

B) 1340 units; 1290 units

C) 1220 units; 1220 units

D) 1248 units; 1120 units

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Weighted-average cost per equivalent unit is obtained

Q16: Estimating the degree of completion for the

Q17: Under the weighted-average method, how would you

Q18: Timekeeper Inc. manufactures clocks on a highly

Q19: Otylia Manufacturing Company assembles its product in

Q21: Ford Motor Company is said to use

Q22: The last step in a process-costing system

Q23: Which of the following most accurately describes

Q24: Serile Pharma places 800 units in production

Q25: Transferred-in costs are treated as if they