Multiple Choice

Shiffon Electronics manufactures music player. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department, the Programming department, and the Testing Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. Shiffon Electronics uses weighted-average costing.

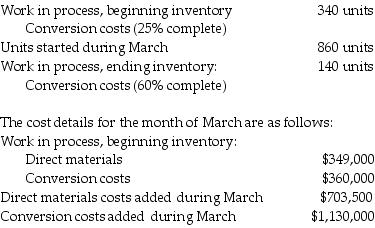

The following information is available for the month of March 2017 for the Assembly department.

What amount of conversion costs is assigned to the ending Work-in-Process account for March?

(Round intermediary dollar amounts to the nearest cent and unit amounts to the nearest whole unit.)

A) $182,343

B) $122,792

C) $109,406

D) $270,629

Correct Answer:

Verified

Correct Answer:

Verified

Q139: A distinct feature of the FIFO process-costing

Q140: Weighty Steel processes a single type of

Q141: Under the FIFO method of process-costing, costs

Q142: Assembly department of Zahra Technologies had 200

Q143: Emerging Dock Company manufactures boat docks on

Q144: Shiffon Electronics manufactures music player. Its costing

Q145: Big Bernard Corporation was recently formed to

Q146: Timekeeper Inc. manufactures clocks on a highly

Q147: Job-costing systems separate costs into cost categories

Q149: When calculating the costs to be transferred