Essay

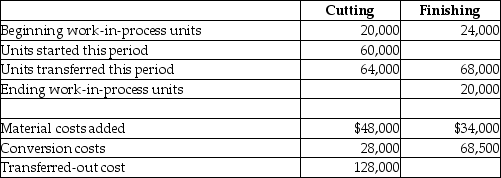

Lexington Company produces baseball bats and cricket paddles. It has two departments that process all products. During July, the beginning work in process in the cutting department was half completed as to conversion, and complete as to direct materials. The beginning inventory included $40,000 for materials and $60,000 for conversion costs. Ending work-in-process inventory in the cutting department was 40% complete. Direct materials are added at the beginning of the process.

Beginning work in process in the finishing department was 80% complete as to conversion. Direct materials for finishing the units are added near the end of the process. Beginning inventories included $24,000 for transferred-in costs and $28,000 for conversion costs. Ending inventory was 30% complete. Additional information about the two departments follows:

Required:

Prepare a production cost worksheet, using FIFO for the finishing department.

Correct Answer:

Verified

Production Cost Work...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q92: Bright Colors Company placed 315,000 gallons of

Q93: Under standard costing the cost per equivalent-unit

Q94: An assumption of the FIFO process-costing method

Q95: Pet Products Company uses an automated process

Q96: Which of the following companies is most

Q98: Which of the following statements is true?<br>A)

Q99: Jane Industries manufactures plastic toys. During October,

Q100: Managers find operation costing useful in cost

Q101: The purpose of the equivalent-unit computation is

Q102: Which of the following statements best describes