Multiple Choice

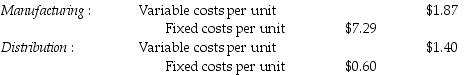

Timekeeper Corporation has two divisions, Distribution and Manufacturing. The company's primary product is high-end watches. Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,009,000 units a week and usually purchases 2,004,500 units from the Manufacturing Division and 2,004,500 units from other suppliers at $10.00 per unit.

What is the transfer price per watch from the Manufacturing Division to the Distribution Division, assuming the method used to place a value on each watch is 170% of variable costs?

A) $1.87

B) $3.18

C) $3.19

D) $8.13

Correct Answer:

Verified

Correct Answer:

Verified

Q51: Which of the following is a part

Q52: The full cost plus a markup transfer-pricing

Q53: The Fabrication Division of American Car Company

Q54: How does cost-based transfer price method help

Q55: Goal congruence exists when individuals work toward

Q57: The seller of Product A has no

Q58: In comparing the three basic approaches to

Q59: Which of the following best describes an

Q60: Cost-based transfer prices are helpful when markets

Q61: When using transfer prices based on costs