Multiple Choice

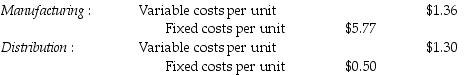

Timekeeper Corporation has two divisions, Distribution and Manufacturing. The company's primary product is high-end watches. Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,009,000 units a week and usually purchases 2,004,500 units from the Manufacturing Division and 2,004,500 units from other suppliers at $13.00 per unit.

Assume 110,000 units are transferred from the Manufacturing Division to the Distribution Division for a transfer price of $8.00 per unit. The Distribution Division sells the 110,000 units at a price of $18 each to customers. What is the operating income of both divisions together?

A) $347,600

B) $392,150

C) $997,700

D) $634,700

Correct Answer:

Verified

Correct Answer:

Verified

Q44: A product may be passed from one

Q45: Which of the following is true of

Q46: The tariffs and customs duties governments levy

Q47: The management accounting system is an informal

Q48: The human resources systems is a part

Q50: An investment center is always a decentralized

Q51: Which of the following is a part

Q52: The full cost plus a markup transfer-pricing

Q53: The Fabrication Division of American Car Company

Q54: How does cost-based transfer price method help