Multiple Choice

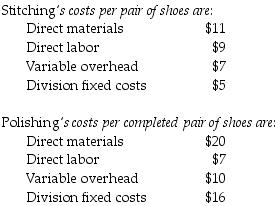

Branded Shoe Company manufactures only one type of shoe and has two divisions, the Stitching Division and the Polishing Division. The Stitching Division manufactures shoes for the Polishing Division, which completes the shoes and sells them to retailers. The Stitching Division "sells" shoes to the Polishing Division. The market price for the Polishing Division to purchase a pair of shoes is $50. (Ignore changes in inventory.) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-103,000 units. The fixed costs for the Polishing Division are assumed to be $22 per pair at 103,000 units.

Calculate and compare the difference in overall corporate net income of Branded Shoe Company between Scenario A and Scenario B if the Assembly Division sells 103,000 pairs of shoes for $120 per pair to customers.

Scenario A: Negotiated transfer price of $33 per pair of shoes

Scenario B: Market-based transfer price

A) $1,751,000 more net income under Scenario A

B) $1,751,000 less net income using Scenario B

C) $103,000 less net income using Scenario A.

D) The net income would be the same under both scenarios.

Correct Answer:

Verified

Correct Answer:

Verified

Q91: _ occurs when a decision's benefits for

Q92: A company should use cost-based transfer prices

Q93: What is goal congruence?

Q94: An advantage of using budgeted costs for

Q95: One of the problems in using one

Q97: Which of the following is true about

Q98: In analyzing transfer prices, the _.<br>A) buyer

Q99: Which of the following is a disadvantage

Q100: Which of the following is a characteristic

Q101: The transfer price creates revenues for the