Multiple Choice

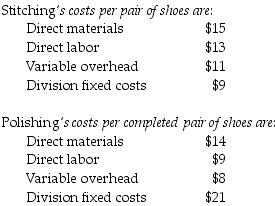

Branded Shoe Company manufactures only one type of shoe and has two divisions, the Stitching Division and the Polishing Division. The Stitching Division manufactures shoes for the Polishing Division, which completes the shoes and sells them to retailers. The Stitching Division "sells" shoes to the Polishing Division. The market price for the Polishing Division to purchase a pair of shoes is $51. (Ignore changes in inventory.) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-110,000 units. The fixed costs for the Polishing Division are assumed to be $20 per pair at 110,000 units.

Assume the transfer price for a pair of shoes is 185% of total costs of the Stitching Division and 40,000 of shoes are produced and transferred to the Polishing Division. The Stitching Division's operating income is ________.

A) $1,632,000

B) $1,120,000

C) $1,400,000

D) $1,320,000

Correct Answer:

Verified

Correct Answer:

Verified

Q141: Cornerstone Company has two divisions. The Bottle

Q142: Division A sells ground veal internally to

Q143: Aerated Water Company makes internal transfers at

Q144: Which of the following is an advantage

Q145: Which of the following is an advantage

Q146: An advantage of a negotiated transfer price

Q147: Why is decentralization costly?

Q148: Hybrid transfer prices take into account both

Q150: For each of the following statements regarding

Q151: Which of the following would be considered