Multiple Choice

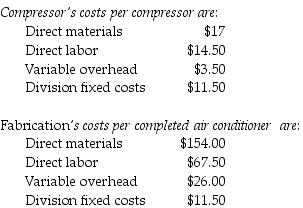

Plish Company manufactures only one type of washing machine and has two divisions, the Compressor Division, and the Fabrication Division. The Compressor Division manufactures compressors for the Fabrication Division, which completes the washing machine and sells it to retailers. The Compressor Division "sells" compressors to the Fabrication Division. The market price for the Fabrication Division to purchase a compressor is $60.00. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 13,000-18,000 units. The fixed costs for the Fabrication Division are assumed to be $11.00 per unit at 18,000 units.

If the Fabrication Division sells 1000 air conditioners at a price of $475.00 per washing machine to customers, what is the operating income of both divisions together?

A) $167,500

B) $169,500

C) $151,000

D) $147,000

Correct Answer:

Verified

Correct Answer:

Verified

Q84: Transfer prices do not affect managers whose

Q85: Management control systems should be designed to

Q86: Axelia Corporation has two divisions, Refining and

Q87: Nig Car Company manufactures automobiles. The Fastback

Q88: The choice of a transfer-pricing method has

Q90: A major advantage of using actual costs

Q91: _ occurs when a decision's benefits for

Q92: A company should use cost-based transfer prices

Q93: What is goal congruence?

Q94: An advantage of using budgeted costs for