Multiple Choice

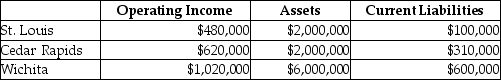

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5,200,000 issued at an interest rate of 13%, and equity capital that has a market value of $4,200,000 (book value of $2,400,000) . Waldorf Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 13%, while the tax rate is 25%.

What is the EVA® for Cedar Rapids? (Round intermediary calculations to four decimal places.)

A) $275,720

B) $465,000

C) $430,720

D) $241,000

Correct Answer:

Verified

Correct Answer:

Verified

Q94: Ventaz Corp. purchased assets for its overseas

Q95: Home Decor Inc., manufactures home cleaning products.

Q96: Many manufacturing, marketing, and design problems require

Q97: All of the following are ways to

Q98: Gas Supply Corporation uses the investment center

Q100: Companies that adopt the EVA concept define

Q101: Discuss the issues and complications that may

Q102: The proponents of using net book value

Q103: The required rate of return multiplied by

Q104: The credit rating agencies require detailed disclosures