Multiple Choice

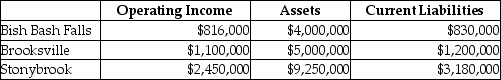

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $17,000,000 issued at an interest rate of 11%, and equity capital that has a market value of $3,000,000 (book value of $4,000,000) . Coldbrook Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 35%.

What is the EVA® for Bish Bash Falls? (Round intermediary calculations to four decimal places.)

A) $530,400

B) $264,061

C) $266,339

D) $159,638

Correct Answer:

Verified

Correct Answer:

Verified

Q86: Bouvous Corporation had the following information for

Q87: Economic value added is equal to _.<br>A)

Q88: Which of the following is true of

Q89: To calculate the value of fixed assets

Q90: In performance evaluations _.<br>A) managers should use

Q92: Return on sales can provide how effectively

Q93: In an EVA calculation, the appropriate measure

Q94: Ventaz Corp. purchased assets for its overseas

Q95: Home Decor Inc., manufactures home cleaning products.

Q96: Many manufacturing, marketing, and design problems require