Multiple Choice

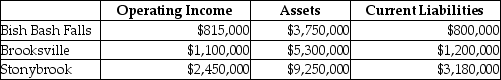

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $19,000,000 issued at an interest rate of 11%, and equity capital that has a market value of $7,000,000 (book value of $5,000,000) . Coldbrook Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 16%, while the tax rate is 35%.

What is the EVA® for Brooksville? (Round intermediary calculations to four decimal places.)

A) $715,000

B) $390,730

C) $166,179

D) $324,270

Correct Answer:

Verified

Correct Answer:

Verified

Q117: Which of the following describes a situation

Q118: Measures which monitor critical performance variables that

Q119: Required rate of return multiplied by the

Q120: Return on investment can be increased by

Q121: Aeralia Inc., has two regional offices. The

Q123: What are the factors involved in choosing

Q124: Vega Corp's corporate income has declined to

Q125: A company has operating income of $300,000,

Q126: Using net book value as an investment

Q127: The top management at Groundsource Company, a