Essay

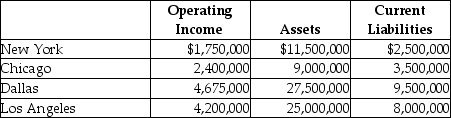

Coptermagic Company supplies helicopters to corporate clients. Coptermagic has two sources of funds: long term debt with a market and book value of $32 million issued at an interest rate of 10%, and equity capital that has a market value of $18 million (book value of $8 million). The cost of equity capital for Coptermagic is 15%, and its tax rate is 30%. Coptermagic has profit centers in four divisions that operate autonomously. The company's results for 2015 are as follows:

Required:

a.Compute Coptermagic's weighted average cost of capital.

b.Compute each division's Economic Value Added.

c.Rank the divisions by EVA.

Correct Answer:

Verified

Correct Answer:

Verified

Q28: The weighted-average cost of capital (WACC) equals

Q29: Return on investment, Residual income, or Economic

Q30: The first step in designing accounting based

Q31: The top management at Groundsource Company, a

Q32: The top management at Groundsource Company, a

Q34: The _ method of profitability analysis recognizes

Q35: A manager's job entails gathering information, interpreting

Q36: Bob's Cellular Phone Company uses ROI to

Q37: The top management at Amore Corp, a

Q38: Companies are increasingly using nonfinancial measures to