Multiple Choice

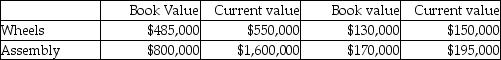

Carriage Incorporated manufactures horse carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2018:

ASSETSINCOME

The company is currently using a 12% required rate of return.

What are Wheels's and Assembly's return on investment based on book values, respectively?

A) 27%; 12%

B) 27%; 21%

C) 12%; 27%

D) 21%; 27%

Correct Answer:

Verified

Correct Answer:

Verified

Q110: Provide the missing data for the following

Q111: _ would be an uncontrollable factor that

Q112: The Cybertronics Corporation reported the following information

Q113: Some companies, make environmental performance a line

Q114: Average number of repeat visits in a

Q116: Customer-satisfaction measures are an example of the

Q117: Which of the following describes a situation

Q118: Measures which monitor critical performance variables that

Q119: Required rate of return multiplied by the

Q120: Return on investment can be increased by