Multiple Choice

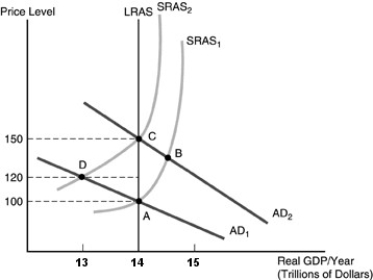

-Refer to the above figure. Suppose the economy is in equilibrium at point A. If the Fed tries to stimulate the economy by undertaking an expansionary monetary policy action and this is not expected by the people in the economy, we would expect to see

A) aggregate demand increases, real GDP increases, and the price level increases. In the long run, aggregate supply would increase and the new long-run equilibrium would be point B.

B) aggregate demand increases, real GDP increases, and the price level increases in the short run. In the long run, people realize the real situation, causing the short-run aggregate supply curve to shift up. Real GDP returns to $14 trillion, and the price level increases to 150.

C) aggregate demand increases but people would anticipate this, causing the short-run aggregate supply curve to shift up at the same time, with the new equilibrium of $14 trillion of real GDP and a price level of 100.

D) aggregate supply shifts up as people anticipate the effects of the expansionary monetary system. In the short run, real GDP falls to $13 trillion and the price level rises to 120. In the long run, real GDP returns to $14 trillion, and the price level increases further, to 150.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: According to the policy irrelevance proposition<br>A) monetary

Q24: According to the new Keynesian sticky-price theory,

Q71: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5018/.jpg" alt=" -Use the above

Q121: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5018/.jpg" alt=" -Refer to the

Q156: A trade-off between unemployment and inflation is

Q191: Which statement is TRUE when rational expectations

Q293: A hypothesis that assumes that people combine

Q299: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5016/.jpg" alt=" -In the above

Q300: Suppose the Fed permanently increases the money

Q301: The natural rate of unemployment is<br>A)zero.<br>B)the unemployment