Essay

THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION:

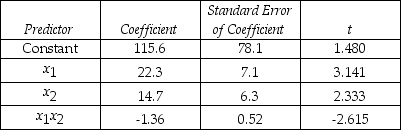

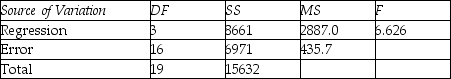

An economist is in the process of developing a model to predict the price of gold.She believes that the two most important variables are the price of a barrel of oil (x1)and the interest rate (x2).She proposes the model y = β0 + β1x1 + β2x2 + β3x1x3 + ε.A random sample of 20 daily observations was taken.The computer output is shown below.

THE REGRESSION EQUATION IS

y = 115.6 + 22.3x1 + 14.7x2 - 1.36x1x2

S = 20.9 R-Sq = 55.4%

ANALYSIS OF VARIANCE

-Is there sufficient evidence at the 1% significance level to conclude that the price of a barrel of oil and the price of gold are linearly related?

Correct Answer:

Verified

H0 : β1 = 0 vs.H1 : β1 ≠ 0

Test statistics: ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Test statistics: ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q72: The model y<sub>t</sub> = 8 + 2.5x<sub>t</sub><sub>

Q73: Explain what is meant by specification bias.What

Q74: Failure to include the proper set of

Q75: Write the model specification and define the

Q76: THE NEXT QUESTIONS ARE BASED ON THE

Q78: In multiple regression analysis,when the independent variables

Q79: If redundant predictor variables are correlated with

Q80: If there is a positive correlation between

Q81: THE NEXT QUESTIONS ARE BASED ON THE

Q82: THE NEXT QUESTIONS ARE BASED ON THE