Essay

THE NEXT QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION:

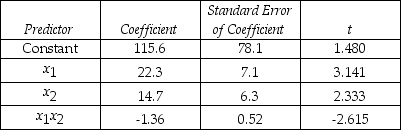

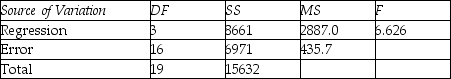

An economist is in the process of developing a model to predict the price of gold.She believes that the two most important variables are the price of a barrel of oil (x1)and the interest rate (x2).She proposes the model y = β0 + β1x1 + β2x2 + β3x1x3 + ε.A random sample of 20 daily observations was taken.The computer output is shown below.

THE REGRESSION EQUATION IS

y = 115.6 + 22.3x1 + 14.7x2 - 1.36x1x2

S = 20.9 R-Sq = 55.4%

ANALYSIS OF VARIANCE

-An economist estimates the regression model yi= β0 + β1x1i + β2x2i + εi.The estimates of the parameters β1 and β2 are not very large compared with their respective standard errors.But the size of the coefficient of determination indicates quite a strong relationship between the dependent variable and the pair of independent variables.Having obtained these results,the economist strongly suspects the presence of multicollinearity.Since his chief interest is in the influence of X1 on the dependent variable,he decides that he will avoid the problem of multicollinearity by regressing Y on X1 alone.Comment on this strategy.

Correct Answer:

Verified

If Y is,in fact,strongly influenced by X...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: THE NEXT QUESTIONS ARE BASED ON THE

Q29: THE NEXT QUESTIONS ARE BASED ON THE

Q30: THE NEXT QUESTIONS ARE BASED ON THE

Q31: Experimental design methods are used extensively in

Q32: Which of the following is true of

Q34: When significant predictor variables are omitted from

Q35: The value of the dependent variable in

Q36: From a statistical perspective,the regression model objectives

Q37: Dummy variables can be used to analyze

Q38: THE NEXT QUESTIONS ARE BASED ON THE