Multiple Choice

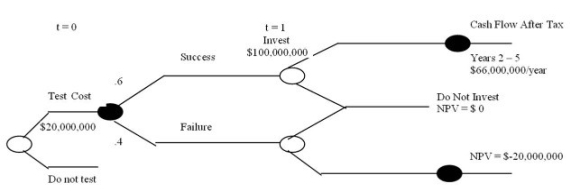

The project defined by the following decision tree has a required discount rate of 14 percent.  What is the Time 1 net present value of a successful investment?

What is the Time 1 net present value of a successful investment?

A) $89,406,415

B) $92,305,012

C) $87,342,087

D) $122,008,054

E) $126,583,344

Correct Answer:

Verified

Correct Answer:

Verified

Q23: In financial breakeven,the EAC is used to<br>A)allocate

Q24: Green Gardens is analyzing a proposed 5-year

Q25: You are considering a project that has

Q26: To make a project accept/reject decision using

Q27: The project defined by the following decision

Q29: A project has an accounting breakeven point

Q30: The investment timing decision relates to<br>A)how long

Q31: A 6-year project has expected sales of

Q32: Wilson's Antiques is considering a project that

Q33: In a decision tree,the accept/reject decision is