Essay

Figure 19-8

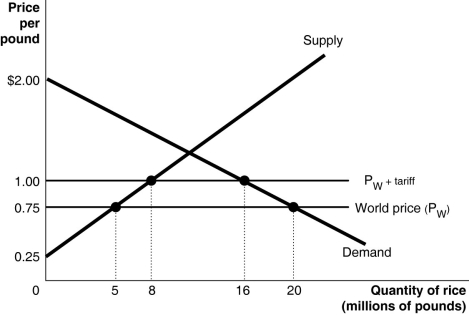

-Refer to Figure 19-8.Suppose the U.S.government imposes a $0.25 per pound tariff on rice imports.Figure 19-8 shows the demand and supply curves for rice and the impact of this tariff.Use the figure to answer questions a-i.

a.Following the imposition of the tariff,what is the price that domestic consumers must now pay and what is the quantity purchased?

b.Calculate the value of consumer surplus with the tariff in place.

c.What is the quantity supplied by domestic rice growers with the tariff in place?

d.Calculate the value of producer surplus received by U.S.rice growers with the tariff in place.

e.What is the quantity of rice imported with the tariff in place?

f.What is the amount of tariff revenue collected by the government?

g.The tariff has reduced consumer surplus.Calculate the loss in consumer surplus due to the tariff.

h.What portion of the consumer surplus loss is redistributed to domestic producers? To the government?

i.Calculate the deadweight loss due to the tariff.

Correct Answer:

Verified

a∙Price = $1.00 per pound; Quantity purc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: If there is currently a surplus of

Q70: If a country has an absolute advantage

Q116: A quota is a numerical limit on

Q118: An economic principle that explains why countries

Q182: Examples of comparative advantage show how trade

Q238: If the dollar appreciates,how will aggregate demand

Q380: Figure 19-4<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6608/.jpg" alt="Figure 19-4

Q381: Table 19-3<br> <span class="ql-formula" data-value="\begin{array}{|l|l|l|}\hline

Q384: Table 19-4<br> <span class="ql-formula" data-value="\begin{array}{|c|c|c|}

Q387: Figure 19-5<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6608/.jpg" alt="Figure 19-5