Multiple Choice

Use the following to answer questions

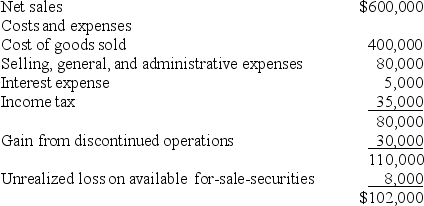

James Company had the following income statement for the year ended December 31, 2010:

-The firm's income before income tax for 2008 was:

A) $200,000

B) $120,000

C) $115,000

D) unable to determine from the information given

Correct Answer:

Verified

Correct Answer:

Verified

Q6: How can full-absorption costing hurt a company?<br>A)business

Q7: What item would not be part of

Q8: Advance Systems,Inc.had 840,000 shares of common stock

Q9: Speed Inc.reported a net income equal to

Q10: In calculating earnings per share,the numerator is:<br>A)income

Q12: A loss on the sale of equipment

Q13: What is compromised when a firm changes

Q14: Under unit-variable costing,<br>A)companies can increase income by

Q15: Jackson,Inc.had 360,000 shares of common stock outstanding

Q16: Use the following to answer questions <br>Kaiser