Essay

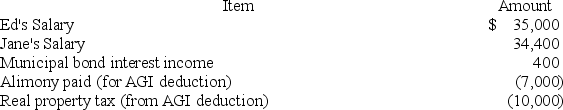

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially.In 2017,Ed and Jane realized the following items of income and expense:

They also qualified for a $1,000 tax credit.Their employers withheld $1,800 in taxes from their paychecks (in the aggregate).Finally,the 2017 standard deduction amount for MFJ taxpayers is $12,700 and the 2017 exemption amount is $4,050.

They also qualified for a $1,000 tax credit.Their employers withheld $1,800 in taxes from their paychecks (in the aggregate).Finally,the 2017 standard deduction amount for MFJ taxpayers is $12,700 and the 2017 exemption amount is $4,050.

What is the couple's adjusted gross income?

Correct Answer:

Verified

$62,400,se...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Char and Russ Dasrup have one daughter,Siera,who

Q2: Itemized deductions and the standard deduction are

Q10: Earl and Lawanda Jackson have been married

Q11: Which of the following statements regarding exemptions

Q13: Inventory is a capital asset.

Q18: Which of the following statements is true?<br>A)Income

Q27: From AGI deductions are generally more valuable

Q57: An individual may meet the relationship test

Q69: The income tax base for an individual

Q124: Taxpayers may prepay their tax liability through