Essay

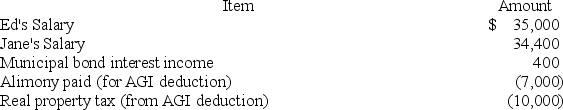

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially.In 2017,Ed and Jane realized the following items of income and expense:

They also qualified for a $1,000 tax credit.Their employers withheld $1,800 in taxes from their paychecks (in the aggregate).Finally,the 2017 standard deduction amount for MFJ taxpayers is $12,700 and the 2017 exemption amount is $4,050.

They also qualified for a $1,000 tax credit.Their employers withheld $1,800 in taxes from their paychecks (in the aggregate).Finally,the 2017 standard deduction amount for MFJ taxpayers is $12,700 and the 2017 exemption amount is $4,050.

What is the couple's taxable income?

Correct Answer:

Verified

$37,550,se...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q36: Tom Suzuki's tax liability for the year

Q43: Anna is a qualifying child of her

Q63: Taxpayers need not include an income item

Q78: Sam and Tacy have been married for

Q80: All of the following are for AGI

Q84: Michael,Diane,Karen,and Kenny provide support for their mother

Q85: For AGI deductions are commonly referred to

Q86: In year 1,the Bennetts' 25-year-old daughter,Jane,is a

Q97: Which of the following statements about a

Q127: An individual may never be considered as