Multiple Choice

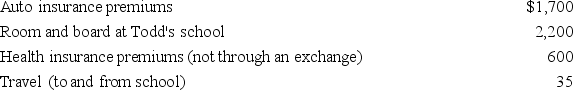

Ned is a head of household with a dependent son,Todd,who is a full-time student.This year Ned made the following expenditures related to Todd's support:  What amount can Ned include in his itemized deductions?

What amount can Ned include in his itemized deductions?

A) $1,700 included in Ned's miscellaneous itemized deductions.

B) $2,050 included in Ned's miscellaneous itemized deductions.

C) $950 included in Ned's miscellaneous itemized deductions.

D) $600 included in Ned's medical expenses.

E) None of the choices are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q40: Claire donated 200 publicly-traded shares of stock

Q60: Which of the following is a true

Q61: An individual who is eligible to be

Q61: Scott is a self-employed plumber and

Q63: The profit motive distinguishes "business" activities from

Q68: Which of the following is a true

Q69: Andres and Lakeisha are married and file

Q70: Jenna (age 50)files single and reports

Q74: Hector is a married, self-employed taxpayer, and

Q90: Bruce is employed as an executive and