Short Answer

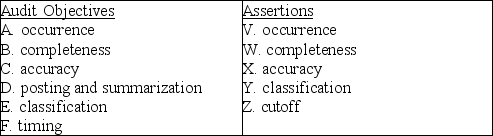

Below are five audit procedures, all of which are tests of transactions associated with the audit of the sales and collection cycle. Also, below are the six general transaction-related audit objectives and the five management assertions. For each audit procedure, indicate (1) its audit objective, and (2) the management assertion being tested.

1. Vouch recorded sales from the sales journal to the file of bills of lading.

1. Vouch recorded sales from the sales journal to the file of bills of lading.

(1) ________

(2) ________

2. Compare dates on the bill of lading, sales invoices, and sales journal to test for delays in recording sales transactions.

(1) ________

(2) ________

3. Account for the sequence of prenumbered bills of lading and sales invoices.

(1) ________

(2) ________

4. Trace from a sample of prelistings of cash receipts to the cash receipts journal, testing for names, amounts, and dates.

(1) ________

(2) ________

5. Examine customer order forms for credit approval by the credit manager.

(1) ________

(2) ________

Correct Answer:

Verified

1. (1) A (2) V

2. (1...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

2. (1...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q118: In the context of the audit of

Q119: The auditor knows more about an audit

Q120: For a private company audit, tests of

Q121: The most important general ledger account included

Q122: _ deals with potential overstatement and _

Q124: The Sarbanes-Oxley Act requires the auditor to

Q125: For publicly listed companies, the auditor also

Q126: Balance-related audit objectives<br>A) are never applied to

Q127: Direct, written communication with the client's customers

Q128: An audit generally provides no assurance that