Multiple Choice

In audits of companies in which payroll is a significant portion of inventory, the improper account classification of payroll can

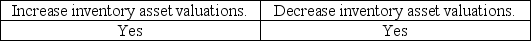

A)

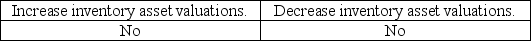

B)

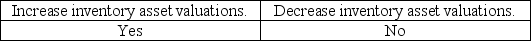

C)

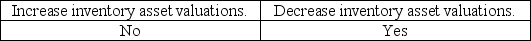

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q14: How do auditors commonly verify sales commission

Q15: For proper internal control, the person(s) responsible

Q16: Which department should be authorized to add

Q17: An analytical procedure to determine a possible

Q18: "Physical control over assets" is not a

Q20: When auditing the payroll and personnel cycle,

Q21: Auditors should determine whether the client has

Q22: The most important means of verifying account

Q23: The auditor _ rely on the internal

Q24: On most audits, the calculation for payroll