Multiple Choice

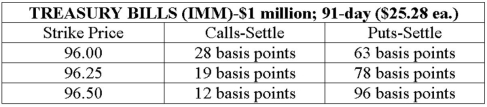

A bank with total assets of $271 million and equity of $31 million has a leverage adjusted duration gap of +0.21 years. Use the following quotation from the Wall Street Journal to construct an at-the-money futures option hedge of the bank's duration gap position.  If 91-day Treasury bill rates increase from 3.75 percent to 4.75 percent, what will be the profit/loss per contract on the bank's futures option hedge?

If 91-day Treasury bill rates increase from 3.75 percent to 4.75 percent, what will be the profit/loss per contract on the bank's futures option hedge?

A) A loss of $556.10 per put option contract.

B) A profit of $556.10 per put option contract.

C) A loss of $1,971.84 per call option contract.

D) A profit of $1,971.84 per call option contract.

E) A profit of $2,528 per put option contract.

Correct Answer:

Verified

Correct Answer:

Verified

Q40: The purchaser of an option must pay

Q46: The premium on a credit spread call

Q60: Which of the following observations is NOT

Q62: A digital default option pays a stated

Q64: The payoffs on bond call options move

Q66: Simultaneously buying a bond and a put

Q73: Futures options on bonds have interest rate

Q82: The payoff values on bond options are

Q122: Regulators tend to discourage, and even prohibit

Q124: A naked option is an option written