Multiple Choice

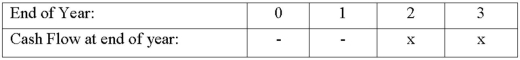

A bank purchases a 3-year, 6 percent $5 million cap (call options on interest rates) , where payments are paid or received at the end of year 2 and 3 as shown below:  Instead of a cap, if the bank had purchased a 3-year 6 percent floor and interest rates are 5 percent and 6 percent in years 2 and 3, respectively, what are the payoffs to the bank?

Instead of a cap, if the bank had purchased a 3-year 6 percent floor and interest rates are 5 percent and 6 percent in years 2 and 3, respectively, what are the payoffs to the bank?

A) The bank will receive $50,000 at the end of year 2 and receive $50,000 at the end of year 3.

B) The bank will receive $50,000 at the end of year 2 and pay $50,000 at the end of year 3.

C) The bank will receive $0 at the end of year 2 and pay $50,000 at the end of year 3.

D) The bank will receive $0 at the end of year 2 and receive $50,000 at the end of year 3.

E) The bank will receive $50,000 at the end of year 2 and pay $0 at the end of year 3.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Rising interest rates will cause the market

Q10: An FI concerned that the risk on

Q37: An option that does NOT identifiably hedge

Q81: Hedging the FI's interest rate risk by

Q86: The tendency of the variance of a

Q103: In April 2012, an FI bought a

Q104: An FI buys a collar by buying

Q108: Credit spread call options are useful because<br>A)its

Q114: The loss to a buyer of bond

Q121: The writer of a bond put option<br>A)receives