Multiple Choice

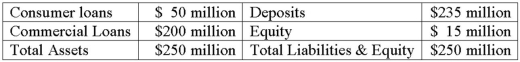

The average duration of the loans is 10 years. The average duration of the deposits is 3 years.  What is the leveraged-adjusted duration gap of the bank's portfolio?

What is the leveraged-adjusted duration gap of the bank's portfolio?

A) 10 years.

B) 7.3 years.

C) 7 years.

D) 7.18 years.

E) 3 years.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: A forward contract has only one payment

Q5: An FI has a 1-year 8-percent US$160

Q10: In a forward contract agreement, the quantity

Q33: An off-balance-sheet forward position is used to

Q48: Hedging effectiveness often is measured by the

Q63: Conyers Bank holds Treasury bonds with a

Q66: A Canadian FI wishes to hedge a

Q70: Who are the common buyers of credit

Q86: A perfect hedge, or perfect immunization, seldom

Q95: XYZ Bank lends $20,000,000 to ABC Corporation