Multiple Choice

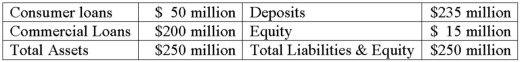

The average duration of the loans is 10 years. The average duration of the deposits is 3 years.  What is the number of T-Bill futures contracts necessary to hedge the balance sheet if the duration of the deliverable T-bills is 0.25 years and the current price of the futures contract is $98 per $100 face value?

What is the number of T-Bill futures contracts necessary to hedge the balance sheet if the duration of the deliverable T-bills is 0.25 years and the current price of the futures contract is $98 per $100 face value?

A) 6,212 contracts.

B) 6,805 contracts.

C) 6,900 contracts.

D) 7,112 contracts.

E) 7,327 contracts.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: A futures contract<br>A)is tailor-made to fit the

Q18: Use the following two choices to identify

Q38: The average duration of the loans is

Q39: Use the following two choices to identify

Q41: Conyers Bank holds Treasury bonds with a

Q42: The sensitivity of the price of a

Q82: Immunizing the balance sheet against interest rate

Q85: A conversion factor often is used to

Q95: Which of the following identifies the largest

Q121: A forward contract<br>A)has more credit risk than