Multiple Choice

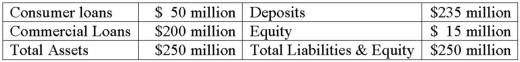

The average duration of the loans is 10 years. The average duration of the deposits is 3 years.  What is the leveraged-adjusted duration gap of the bank's portfolio?

What is the leveraged-adjusted duration gap of the bank's portfolio?

A) 10 years.

B) 7.3 years.

C) 7 years.

D) 7.18 years.

E) 3 years.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: A U.S. bank issues a 1-year, $1

Q4: Use the following two choices to identify

Q5: An FI has a 1-year 8-percent US$160

Q10: Conyers Bank holds Treasury bonds with a

Q19: It is not possible to separate credit

Q32: Catastrophe futures contracts<br>A)are designed to protect life

Q78: An FI has reduced its interest rate

Q90: All bonds that are deliverable under a

Q102: Which of the following measures the dollar

Q227: A U.S. bank issues a 1-year, $1