Multiple Choice

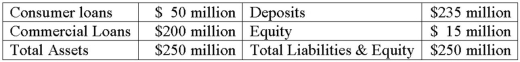

The average duration of the loans is 10 years. The average duration of the deposits is 3 years.  What is the change in the value of the FI's equity for a 1 percent increase in interest rates from the current rates of 10 percent ?

What is the change in the value of the FI's equity for a 1 percent increase in interest rates from the current rates of 10 percent ?

A) -$,979,091.

B) -$16,318,182.

C) -$15,979,091.

D) +$16,318,182.

E) +$979,091.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: A U.S. bank issues a 1-year, $1

Q4: Use the following two choices to identify

Q13: What does R<sup>2</sup> = 0 indicate?<br>A)Changes in

Q37: In a credit forward agreement hedge, the

Q44: Forward contracts are marked-to-market on a daily

Q65: A forward contract specifies immediate delivery for

Q72: An FI issued $1 million of 1-year

Q103: Delivery of the underlying asset almost always

Q107: Hedging foreign exchange risk in the futures

Q125: Use the following two choices to identify