Multiple Choice

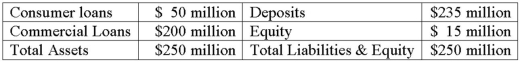

The average duration of the loans is 10 years. The average duration of the deposits is 3 years.  What is the number of T-bond futures contracts necessary to hedge the balance sheet if the duration of the deliverable bonds is 9 years and the current price of the futures contract is $96 per $100 face value?

What is the number of T-bond futures contracts necessary to hedge the balance sheet if the duration of the deliverable bonds is 9 years and the current price of the futures contract is $96 per $100 face value?

A) 1,630 contracts.

B) 1,475 contracts.

C) 1,900 contracts.

D) 2,078 contracts.

E) 3,225 contracts.

Correct Answer:

Verified

Correct Answer:

Verified

Q49: When will the estimated hedge ratio be

Q57: The notational value of the world-wide credit

Q73: An agreement between a buyer and a

Q74: A credit forward agreement specifies a credit

Q78: An FI has reduced its interest rate

Q88: If a 12-year, 6.5 percent semi-annual $100,000

Q125: An adjustment for basis risk with a

Q213: Conyers Bank holds Treasury bonds with a

Q220: A Canadian FI wishes to hedge a

Q222: A U.S. bank issues a 1-year, $1