Multiple Choice

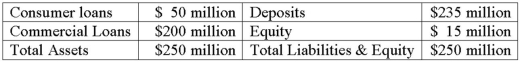

The average duration of the loans is 10 years. The average duration of the deposits is 3 years.  What is the number of T-Bill futures contracts necessary to hedge the balance sheet if the duration of the deliverable T-bills is 0.25 years and the current price of the futures contract is $98 per $100 face value?

What is the number of T-Bill futures contracts necessary to hedge the balance sheet if the duration of the deliverable T-bills is 0.25 years and the current price of the futures contract is $98 per $100 face value?

A) 6,212 contracts.

B) 6,805 contracts.

C) 6,900 contracts.

D) 7,112 contracts.

E) 7,327 contracts.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Macrohedging uses a derivative contract, such as

Q8: The current price of June $100,000 T-Bonds

Q17: A futures contract<br>A)is tailor-made to fit the

Q20: Tailing-the-hedge normally requires an FI manager to

Q31: An agreement between a buyer and a

Q33: An off-balance-sheet forward position is used to

Q37: In a credit forward agreement hedge, the

Q57: Basis risk occurs when the underlying security

Q66: Catastrophe futures are designed to hedge extreme

Q74: A credit forward agreement specifies a credit