Multiple Choice

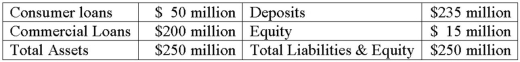

The average duration of the loans is 10 years. The average duration of the deposits is 3 years.  What is the number of T-bond futures contracts necessary to hedge the balance sheet if the duration of the deliverable bonds is 9 years and the current price of the futures contract is $96 per $100 face value and if basis risk shows that for every 1 percent shock to interest rates, i.e., ΔR/(1 + R) = 0.01, the implied rate on the deliverable bonds in the futures market increases by 1.1 percent, i.e., ΔRf/(1 + Rf) = 0.011?

What is the number of T-bond futures contracts necessary to hedge the balance sheet if the duration of the deliverable bonds is 9 years and the current price of the futures contract is $96 per $100 face value and if basis risk shows that for every 1 percent shock to interest rates, i.e., ΔR/(1 + R) = 0.01, the implied rate on the deliverable bonds in the futures market increases by 1.1 percent, i.e., ΔRf/(1 + Rf) = 0.011?

A) 1,500 contracts.

B) 1,888 contracts.

C) 2,100 contracts.

D) 2,408 contracts.

E) 3,100 contracts.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Tailing-the-hedge normally requires an FI manager to

Q29: Conyers Bank holds Treasury bonds with a

Q60: An agreement between a buyer and a

Q99: Commercial banks, investment banks, and broker-dealers are

Q106: The uniform guidelines issued by bank regulators

Q109: The hedge ratio measures the impact that

Q157: Use the following two choices to identify

Q159: The average duration of the loans is

Q197: An FI has a 1-year 8-percent US$160

Q206: An FI has a 1-year 8-percent US$160